Recent Posts

Fleet Compliance Software: How to Pick the Right One

Why DriverReach Users Should Consider Switching to Double Nickel

The Future of the Trucking Industry: 6 Trends Shaping the Road Ahead

What Is DQ File Management and Why Does It Matter for Fleet Operators?

Free Grants to Start a Trucking Company: What You Need to Know

The Importance of Driver Training: How to Build a Safer, More Efficient Fleet

How Manas Express Grew Driver Hires by 2x with Double Nickel's CDL Recruiting Software

Top Strategies for Enhancing Driver Engagement and Satisfaction

Recruiting Truck Drivers: Strategies to Build a Strong Workforce

Driver Qualification File Checklist: A Comprehensive Guide

CDL Recruiting: Why You Should Aim for 70%+ Contact Rates

The Future of Trucking Recruitment: Will AI Replace Recruiters?

How AI is Changing CDL Driver Recruiting in 2025

How to Run Effective Re-Engagement Campaigns for Older Leads

Data-Driven Lead Engagement: How to Track and Improve Your Contact Rates

The Most Common Mistakes Recruiters Make in Lead Engagement (And How to Fix Them)

The CDL Recruiter’s Guide: Answering Driver Questions with Confidence

Best Ways to Recruit CDL Drivers in 2025

How to Improve Contact Rates for Drivers Applying Outside Business Hours

AI Automation vs. Manual Outreach: How to Expand Lead Engagement Without Increasing Team Size

The Ideal Number of Times to Reach Out to an Applicant

The Ultimate Guide to Automating Your Recruiting Process with AI Voice Agents

5 Steps to Reduce Driver Ghosting with Instant Engagement

Customer Testimonial: How Barber Trucking Streamlined Recruiting with Double Nickel

Double Nickel Launches Virtual Recruiter to Revolutionize CDL Driver Hiring

Case Study: How Jett Express Digitize its Recruiting & Compliance Operation with Double Nickel

How Jett Express Transformed their Recruiting Process & Filled Empty Trucks with Double Nickel & KJ Media 🚛✨

Driver Onboarding: How to Automate It

How can AI help fleets manage driver recruiting & retention in the next freight bull market?

Case Study: Streamlining Driver Hiring at ABL Trucking

Recruiting Strategies for Success: The Power of Consistency throughout the Hiring Cycle

Recruiting Strategies for Success: Keeping Driver Candidates Engaged Throughout the Qualification Process

Recruiting Strategies for Success: Maximizing Your Contact Rate

Cost-Effective Driver Recruitment: Best Practices to Make the Most of Your Marketing Budget

Market Outlook: What does a rebound in the freight market mean for driver recruiting and how can carriers get ahead of it?

Case Study: Redbone Trucking's Success with Double Nickel

Revolutionize Your CDL Driver Recruitment: Catch Up with Our Recent Webinar

Double Nickel Featured on Radio Nemo

Strategies to reduce cost to hire by reengaging prior applicants

Analyzing the Low Participation in the Under-21 Truck Driver Apprenticeship Program

Navigating the Freight Recession and Preparing for Future Growth

Delving Into the True Cost of Driver Turnover

Delving Into the True Cost of Driver Turnover

Apr 30, 2024

2 min

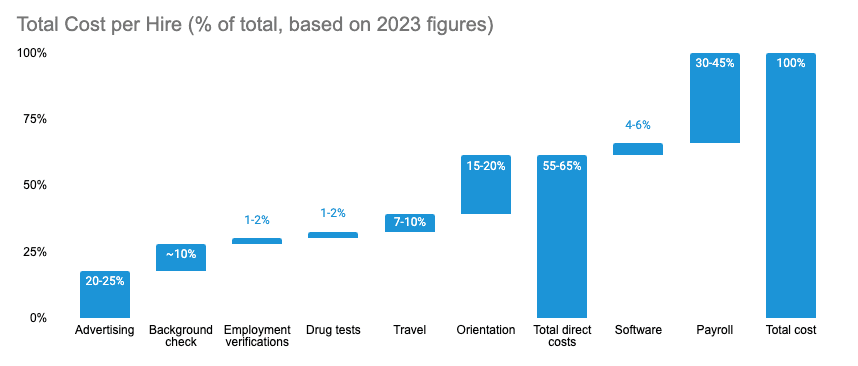

In our dialogue with carriers of all sizes, one theme that stands out is the total cost of driver turnover and its influence on the ROI of retention efforts. Carriers with lower turnover rates stand out for their comprehensive approach to evaluating the fully loaded cost per hire, allowing them to properly assess the ROI of investing in retention strategies 🔄✨

A common pitfall? Equating cost per hire solely with media cost per hire (💵 spent on leads / # hires), a perspective that often leads to underestimating the full scope of the issue and, consequently, underinvesting in retention 📉🔍

🔑 A few findings worth highlighting on this topic from our research across carriers:

Advertising: Merely the Beginning 🌊: In 2023, advertising expenses were less than 20% of the total hiring cost for medium-sized carriers. Even in 2021, at the height of the freight market, this figure was around 50%. In other words, media or advertising cost represents just a fraction of the entire expenditure! 🥧

People cost: The Overlooked Behemoth 💰: Though "fixed" in the short term, payroll costs (i.e. recruiters salary) represent a significant part of hiring expenses and should be built into the cost when considering long term initiatives that could automate the process and increase productivity. 🔄

Software: The Underestimated Ally 🖥️: Making up about 5% of the total hiring cost, software spending unveils a substantial ROI opportunity for technologies aimed at reducing turnover or hiring expenses. 🚀

🎯 The Core Insight? Carriers are often underestimating the cost per hire by not including key cost items, impacting their ability to plan effective long-term retention initiatives. This narrow focus risks underinvestment and overlooks the broader financial impact. By adopting a more holistic view, we not only clarify the financial stakes but also pave the way for more impactful, sustainable strategies. 🌟

📣 To carriers out there, how are you thinking about cost per hire and how does that influence your decision on retention strategies? We hear you!